Blog

The State of Financial Literacy Education in Our Schools

My decision to embark on this journey of writing a children’s book series focused on financial literacy stemmed from the noticeable gaps in the existing resources for financial education across our nation. Although I was raised in an environment where discussions about personal finances, savings, and investments were common, sparking my passion for finance both academically and professionally, the truth is that many children lack this opportunity and miss out on essential financial lessons at home.

After dedicating a significant portion of my investment career to being a research analyst, I’m excited to don my analyst hat for you for just a moment and reveal some eye-opening statistics that inspired my financial literacy children’s book campaign. I hope you will find this information valuable (and not put you to sleep!) regarding the importance of introducing your children to financial concepts sooner rather than later.

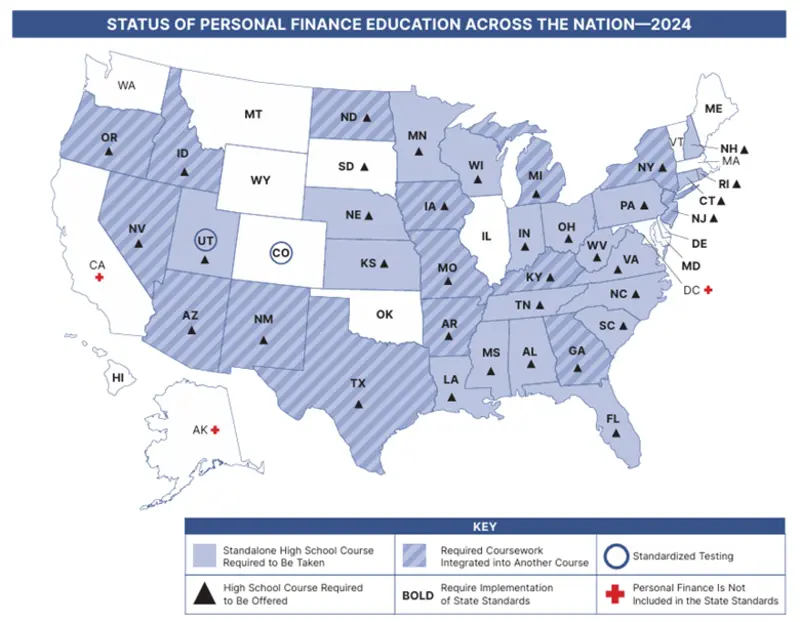

So let’s get this going! A survey conducted by the Council of Economic Education (CEE) reveals that 35 states now mandate high school students to complete a personal finance course for graduation, a significant increase from 23 states just two years prior (see map below). However, high school students are scoring a mere 57.5% on financial literacy tests on average (yes, that is an F on a typical grading scale if anyone was wondering), underscoring a crucial knowledge gap. The current landscape of financial literacy education in America’s public schools leaves much to be desired, highlighted by this concerning statistic.

A prevalent concern is the readiness of teachers to effectively instruct business in their classrooms. A detailed study conducted by the National Endowment for Financial Education shows that only 37% of K–12 teachers have completed a college course in personal finance. Furthermore, fewer than 20% feel equipped to teach any of the six essential personal finance topics with only 11.6% having participated in workshops focused on teaching personal finance. Moreover, 63.8% do not believe they are qualified to teach their state’s financial education standards and less than 30% have ever instructed on financial education topics. Additionally, teaching kids about business comes with its own set of trade-offs compared to other subjects. With a finite number of days and hours available for teaching students in a school year, incorporating finance lessons will necessitate a reduction in other subjects.

Despite an increasing number of states requiring a finance course for graduates, students typically only receive 20–25 hours of financial education throughout their entire school journey, as reported by the National Financial Educators Council. To provide some context, students accumulate anywhere between 200 to over 300 hours of geometry during their K-12 education. However, research indicates that fewer than 5% consistently use geometry in their careers or daily lives after high school. This pales in comparison to the nearly 100% of individuals who incorporate financial literacy into their daily lives, regardless of their career choices.

This issue extends beyond just high schools though. Opportunities to teach kids about money exist from kindergarten to 12th grade but often go untapped. With parents frequently struggling to grasp financial concepts themselves, it makes it all the more challenging to educate their children about money.

So, this is my CALL TO ACTION! I encourage parents and mentors to introduce their kids to basic financial concepts early on through children’s books, engaging conversations, and enjoyable activities. This way, when they reach high school, financial literacy will feel familiar and accessible, not a foreign topic. Lacking financial literacy can lead to serious consequences, including increased debt, insufficient savings, financial instability, and poor financial choices in adulthood.

Let’s join forces and educate our youth, ensuring that the next generation is well-equipped to avoid economic struggles and ready to tackle any challenge that lies ahead with financial wisdom and confidence!

Check out our website for book offerings, tips, fun facts, and FREE downloadable activities to help in your child’s financial educational journey. Also, sign up for our newsletter to get articles like this sent directly to your email inbox!

Social media

Free Welcome Bundle

Subscribe to my newsletter and receive a FREE welcome bundle, news, latest blogs, as well as updates on upcoming books & events.